Spend v2 Release Notes

Welcome to the Spend V2 Release Notes! 💳

Since we officially launched Spend in Jan 2022 (PR, Webinar), we’ve been hard at work expanding coverage to include more POIs in the dataset. In just the few short months since our initial release, we’ve more than doubled our coverage! Spend now includes over 1M POIs, including both branded and non-branded POIs!

(release-spend-2022-03-04)

What’s New in V2

- Spend Data for Non-Branded POIs 🎉

- Much More Spend Data for Branded POIs ⏫

- Improved Accuracy when Using Spend Data 📈

Spend Data for Non-Branded POIs

SafeGraph Places is the best-in-class dataset for places of interest, and it includes more than just the location of every Starbucks and Dunkin' Donuts. It includes independent coffee shops as well ☕!

Because of the comprehensiveness of the Places dataset, we were able to expand our initial matching process for Spend to include transactions at non-branded businesses. As a reminder, what we call “non-branded” is any brand with less than 3 physical locations. So this means that you can find anything from local pizza places (e.g., 21st Century Pizza in Portland, Oregon 🍕) to major single-location attractions (e.g., Pittsburgh Zoo & PPG Aquarium in Pittsburgh, PA🦒).

(Incidentally, you’ll find both of the above POIs in this release of Spend 😉)

Much More Spend Data for Branded POIs

We’ve also been working to improve our branded POI coverage. In V1, coverage of many well-known brands was high, but we’ve looked to improve on that coverage in two ways:

Coverage of More Brands

We’ve more than tripled the number of brands we now include in our Spend dataset. We now include over 3,700 brands, an increase of +225%! 💯 💯 💯

Some of the notable new entrants include:

- Firestone Complete Auto Care (

SG_BRAND_c8cd3015bd66459919ee3d72cfb148f6) 🚘 - DSW (Designer Shoe Warehouse) (

SG_BRAND_5c86a42a67f4dda45e700158726465ad) 👞 - Torrid (

SG_BRAND_7952f2bb94aeba1bf78fa01c4a34834a) 👗 - Nothing Bundt Cakes (

SG_BRAND_06e63dbcb0f18f13ff92bd23dd7f2213) 🍰 - Safeway Fuel Station (

SG_BRAND_01b97aeabf5d692f) ⛽ - Perkins Restaurant & Bakery (

SG_BRAND_d1cfc90288a050428014409f080279a2) 🥖 - GIANT Food Stores (

SG_BRAND_66bde8c0f4a4dfdaea9291efa4b3c7a1) 🛒

Better Coverage of All Brands

And for all brands, we’ve improved and expanded the way we associate transactions to individual POI so we’ve managed to increase the number of stores where we are calculating Spend data. A couple quick stats:

- 713 of the original Spend brands increased in coverage by 50 percentage points or more (E.g., from 40% coverage to 90% of POIs covered).

- Put another way, over half of the original brands doubled their POI coverage ⏫

- Over 3,000 brands had more POIs with coverage in V2 than in V1 (this includes net new brands)

Overall, this means Spend data is now available for POIs across many more brands, from AMF Bowling 🎳 (100% V2 coverage) to Zara 👜 (95% V2 coverage). As always, you can find plenty of coverage details on our Spend Summary Statistics page.

Improved Accuracy when Using Spend Data

Along with improvements in POI coverage, we’re also performing more and more analyses on the signal present in our Spend data. You may have seen our blog post showing high correlations between our Spend data and quarterly revenue from Target, Chipotle, and McDonald’s.

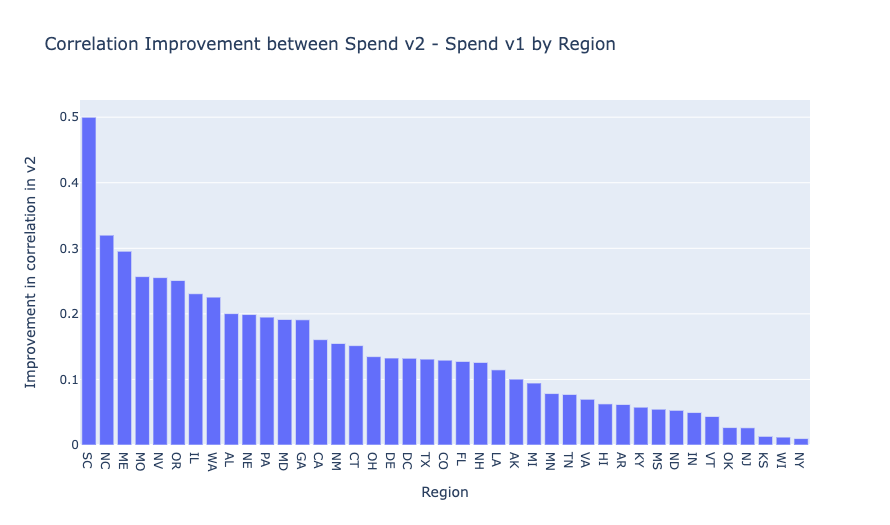

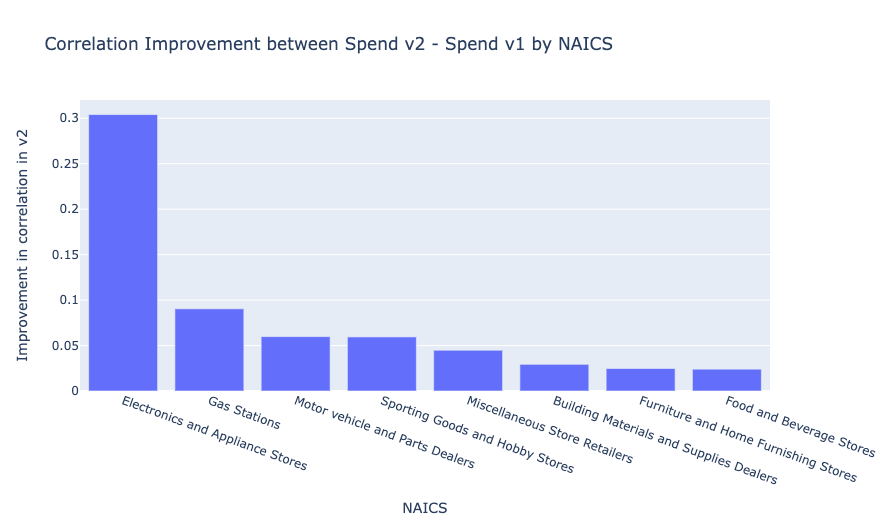

Beyond just Spend rolled-up by brand or company, we’ve also compared our trend data to Census data from the MRTS. This is a survey-based approach that reports state-by-state trends by 3-digit naics code.

In V2, correlations to the Census MRTS improved in 41 of 51 regions in the US! We saw big gains in South Carolina, Maine, and North Carolina in particular (all improved by over +0.25 net correlation - calculated where each month’s YoY trend value is an observation).

7 of the 11 NAICS categories also improved with V2. Electronics and Appliance stores in particular had a +0.25 net correlation change, the biggest boost out of any category.

All of this is to say that we’re growing and improving the product at a rapid rate. We’re laser-focused on making sure the data are high quality, showing strong signal to ground truth measurements, and available for as many Places people care about as possible.

Have a suggestion? A question? A cool use case? Please reach out and let us know!